THE WALL STREET JOURNAL | REAL ESTATE | Esther Fung

Some real-estate investment trusts tend to perform well during times of uncertainty

As the spread of the coronavirus disrupts travel plans and pummels shares of hotel owners, some corners of real estate are emerging as safer places for investors.

A number of real-estate investment trusts tend to outperform the broader stock market during times of economic uncertainty because landlords with longer leases often can count on a more stable cash flow than manufacturers or financial companies.

REITs are also more sensitive to interest rates than most companies because of the amount of debt they use to distribute income as dividends. That makes some of these companies among the bigger winners when the Federal Reserve cut short-term rates last week.

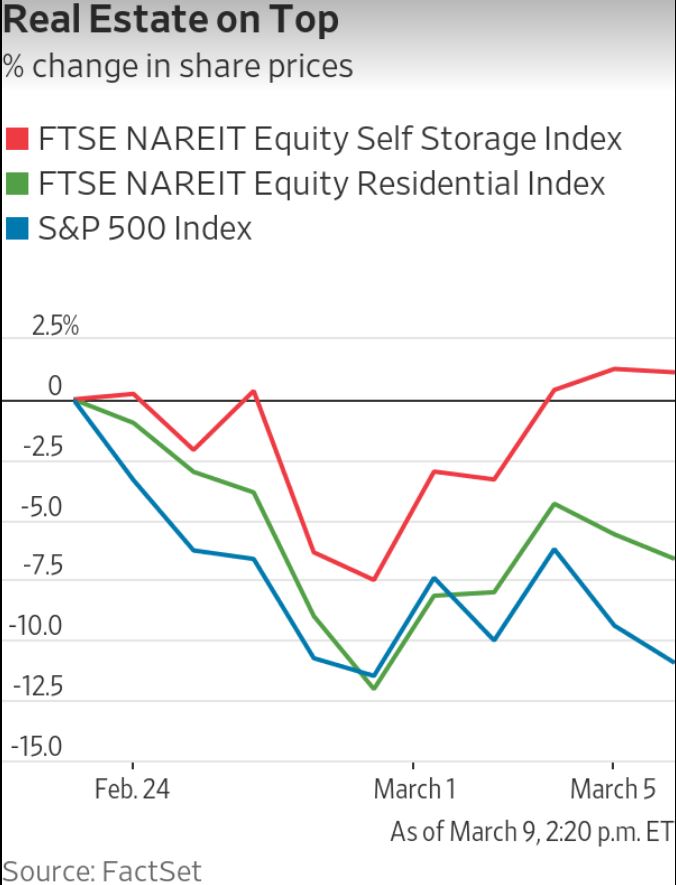

The past two weeks have borne out these factors, as investors flocked to owners of self-storage, rental-housing and infrastructure properties that have lower tenant turnover, making them typically less vulnerable to economic disruptions.

Since the stock-market selloff gained steam on Feb. 24, the FTSE Nareit All REITs Index has fallen 12% and the S&P 500 has fallen 14% over the same period. Within real estate, the self-storage sector was the top performer, with returns largely flat.

Not all real-estate owners stand to gain. Those with exposure to development projects or borrowing needs face more challenges, analysts said. Lenders could become more conservative in rolling over debt, while developers could face disruption if their construction workers fall sick or if building supplies are delayed.

Analysts are also skittish about office and warehouse owners, despite the multiyear leases on their books. Their fortunes are more closely linked to economic growth, which investors anticipate will suffer if the epidemic persists. Office-tower owner Vornado Realty Trust has fallen 21% and industrial property landlord Prologis Inc. has slid 19% since Feb 24.

In the case of self-storage units, people still need a place to park their things and the costs tend to be affordable for most customers, said Ki Bin Kim, managing director at SunTrust Robinson Humphrey Inc. overseeing REIT Equity Research. “It doesn’t rely on foot-traffic volume, unlike other real estate such as movie theaters or retail that depend on people being comfortable in crowded areas,” said Mr. Kim.

Since Feb. 24, shares of self-storage landlords such as Public Storage rose 1.8%, while Extra Space Storage Inc. and CubeSmart have fallen 2%, a limited loss compared with the broader market selloff. Shares of infrastructure and residential REITs have also held up better against the broader market, falling between 3.3% and 10%.

Communication networks still function even with people staying home, so owners of cell towers and fiber networks are less likely to be directly affected. Residential property landlords say that rental housing focused on the moderately priced dwellings tends to hold steady during recessions.

“People who didn’t lose their jobs sheltered in place,” said Richard Campo, chief executive officer at Houston-based apartment landlord.

Within the residential sector, shares of mobile-home-park owners were less affected on the down days, falling by 4.5% since Feb 24. Sun Communities Inc. and Equity LifeStyle Properties, which typically own the land where manufactured homes are parked, are expected to hold on to their strong occupancy rates as supply of new sites is limited.

Typically, health-care real estate is also a safer bet in a recession, but investors have shied away from landlords of nursing homes and senior living centers in the past two weeks. Elderly residents are more vulnerable and have a higher mortality rate in a coronavirus outbreak. These properties also tend to have shorter-term leases, often on a month-to-month basis, making them more vulnerable during periods of economic stress.

The FTSE Nareit Equity Health Care index has fallen 23% since Feb 24.

THE WALL STREET JOURNAL | REAL ESTATE | Esther Fung | Original Article